As originally published by Financial Advisor magazine.

In our article last month we examined how prospects, when searching for an advisor, trust the recommendations of their friends and family the most, but they also notice brands and assign a lot of importance to the reputation of the firm. The survey conducted by The Ensemble Practice LLC among consumers with over $100,000 in income reveals that while “Who can I trust?” is the fundamental question all investors ask, there are significant differences in who they ask this question to based on their wealth, age, gender and sources of wealth.

Wealth Makes a Difference

Wealthy investors (i.e., people with a net worth over $1 million) approach their search for an advisor differently. They are less likely to consider the recommendation of a friend, relying more on the opinions of other advisors (such as CPAs and attorneys). They are more likely to shop around, interviewing more than one advisor before making their choice. They are also more likely to already be using the firm for other services. Once they enter into an advisory relationship, the wealthy are more likely to be disappointed by their advisor and less likely to make a referral.

Age Also Matters (But Wealth Matters More)

The likelihood of an individual working with an advisor increases steadily with age. Only 18.4% of Gen Z consumers (under 25 years of age) work with an advisor. Compare this to 38.7% of baby boomers (between 57 and 75 years of age) and 45.5% of the silent generation (over 75 years of age). That said, young consumers with high levels of wealth (over $1 million in net worth) behave more similarly to older consumers with comparable levels of wealth than their less wealthy peers in the same age cohort. All age groups rely primarily on the recommendation of someone they trust when selecting an advisor, even if younger consumers are more likely to gather information from online sources.

Women Are Underserved And Choose Differently

Female consumers are less likely to have an advisor (29.5%) than male consumers (36.2%). They also trust their friends and family more than men do when it comes to choosing an advisor (24.1% of women versus 14.0% of men rely on the recommendation of a friend or family member). Compared to their male counterparts, females are less impressed with sales presentations (8.0% versus 15.0% of men) and more concerned that they do not know how to choose an advisor (23.7% versus 18.8% of men).

Business Owners Are A Different Breed

Both during the process of selecting their advisor and afterward when engaging in the relationship, business owners exhibit unique behavior. They are more impressed by presentations (23.1%) than consumers at large (12.0%) and rely more on their CPAs for recommendations (15.4% of business owners versus 9.4% of all consumers). Once in an advisory relationship, they are more likely to be promoters of their advisor (30.8% versus 19.4% of all consumers) and make referrals (79.6% versus 52.9% of all consumers).

Let’s elaborate on each of the demographic categories.

Wealth Matters the Most

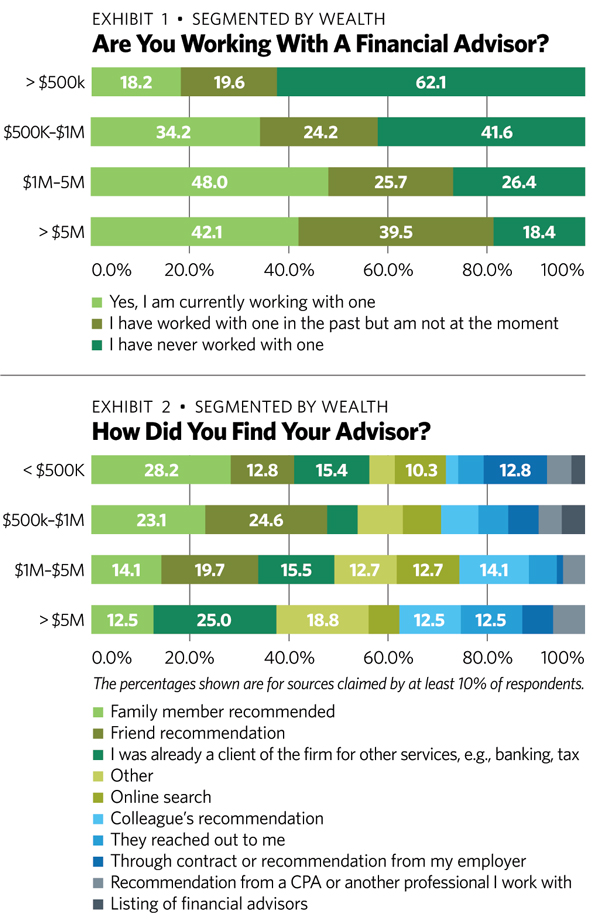

The popularity of professional financial advice as a service moves in tandem with wealth, increasing as we look at higher levels of wealth in the consumer pool. Indeed, this conclusion is intuitive, and advisors are already aware of the correlation. As shown in Exhibit 1 below, only 18.2% of people with less than $500,000 in wealth work with an advisor. Compare this to 34.2% of consumers with between $500,000 and $1 million in wealth, 48.0% of those with a net worth between $1 million and $5 million and 42.1% of the wealthiest consumers.

While people in general rely primarily on the advice of friends and family when exploring potential advisors, the wealthiest investors depend far less on the recommendations of family and appear to have no friends. As shown in Exhibit 2, only 12.5% of consumers with over $5 million in net worth found their advisor through a family member, and none reported finding their advisor through a friend. Compare this to the behavior of those with net worth under $500,000, over 40% of whom relied on the recommendation of a family member (28.2%) or friend (12.8%) when selecting their advisor.

Another interesting behavioral distinction illustrated in Exhibit 2 is that the highest wealth category of investor is much more likely to rely on an existing firm relationship when selecting an advisor. The wealthiest investors are also more likely to have considered “other” sources of recommendation when selecting their advisor (18.8%), providing write-in responses such as “I followed the advisor through different companies.”

Another significant behavioral difference correlated with an individual’s wealth is the number of advisors considered during the examination stage. The more wealth a person has, the more likely they are to consider multiple advisors before ultimately selecting one. Only 23.1% of people with a net worth less than $500,000 considered multiple advisors during their selection process. In contrast, 56.3% of consumers with a net worth greater than $5 million shopped around interviewing more than two advisors.

The significance of a firm’s brand to the consumer during the advisor selection process also shows a wealth dynamic. People with higher levels of wealth are more likely to assign equal weight to the advisor and the brand when choosing an advisor and less likely than consumers with lower levels of wealth to gravitate toward brand-heavy firms. Conversely, investors with lower net worth rely more on the assurance provided by a large firm brand than their high-net-worth counterparts.

Finally, when looking at referrals segmented by a person’s wealth, we see that wealthy consumers are less likely to make referrals than those with lower levels of net worth. However, they are also the more likely to be raving fans.

Of the consumers surveyed, those with the highest levels of wealth (over $5 million) are the least likely to have referred someone to their advisor (43.8% report that they have not). Compare this percentage to consumers with less than $500,000 in net worth, 30.8% of whom report that they have not made a referral. That said, the highest wealth category also has the highest percentage of raving fans, with 25% of high-net-worth investors reporting that they routinely recommend their advisor.

Behavioral Characteristics by Gender

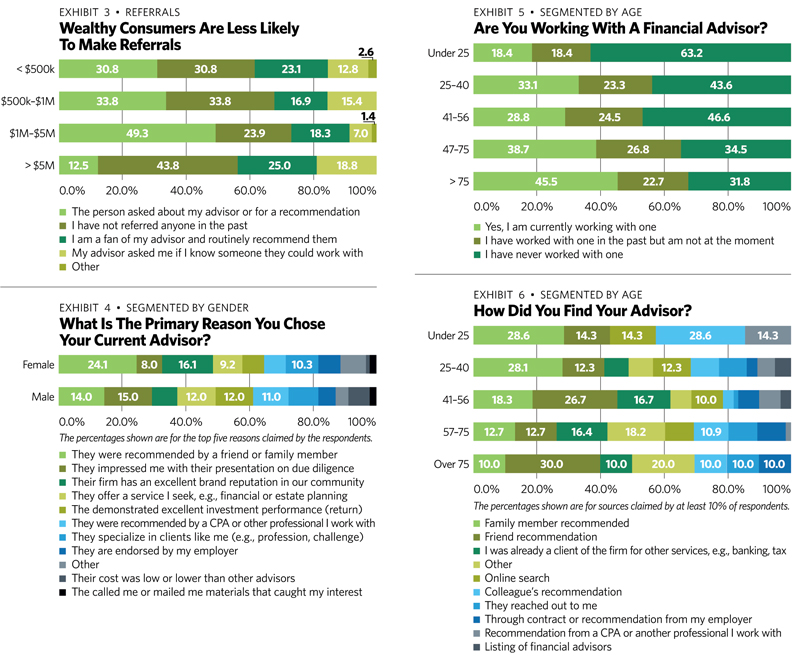

Women demonstrate some notable differences in how they choose an advisor. When compared to male consumers, women rely much more on the recommendation of friends and family when selecting their advisor and trust sales presentations less.

As shown in Exhibit 4, nearly a quarter of women (24.1%) chose their advisor based on the recommendation of someone with whom they are close, compared to 14.0% of men who did the same. Men, on the other hand, were most swayed by the sales presentation of their advisor (15.0%). The reputation of the firm’s brand in the community is also an important factor to women, with 16.1% of women consumers reporting that this was the primary factor in their advisor selection process.

For men, service menu considerations and investment performance also scored high marks. Male consumers were also much more likely to consider the recommendation of their CPA or other professional in their decision (11.0% of men compared to 6.9% of women).

In addition to considering different primary factors than men when choosing an advisor, women also feel less certain of how to go about selecting an advisor. When asked to identify the main reason they manage their own investments, 23.7% of female respondents without an advisor reported that they either lack the time or the knowledge to pick an advisor compared to 18.8% of male respondents. Women consumers are also much more concerned with the possibility of encountering fraud or receiving bad advice, with 18.5% of women versus 10.3% of men voicing this as a reason behind their reluctance to seek professional advice.

Differences by Age

Much has been written about the differences between generations and the contrasting values they hold. While we certainly note some generational behavioral differences in our sample, we find that level of wealth is a stronger predictor of a consumer’s behavior than age.

The fact that wealth is a stronger behavioral indicator than age shows itself most clearly when looking at which consumers choose to work with a financial advisor. As shown in the graph, the likelihood of working with an advisor increases with an individual’s age, with only 18.4% of Gen Z (under 25 years old) in an advisory relationship compared to 38.7% of baby boomers (57 to 75 years old) and 45.5% of the silent generation (over 75 years old). However, 54.2% of baby boomers and 63.6% of the silent generation have net worth over $1 million. In contrast, only 15.7% of millennials have achieved this level of wealth.

That said, generational differences do seem to play a significant behavioral role during the exploration stage in terms of which sources consumers depend on to find an advisor. When it comes to selecting potential advisors to consider, a steady percentage of investors across age groups rely on the recommendation of someone with whom they are close, either a friend or family member. However, the younger the investor, the more likely it is that the recommendation comes from a family member, perhaps a parent (28.6% of Gen Z). For members of the silent generation, it is more likely that this recommendation comes from a friend (30.0%).

Another key generational trend revealed by the survey is a person’s likelihood to use online search as a method to identify potential advisors. While 14.3% of Gen Z and 12.3% of millennials used online search to find their advisor, this percentage declines with age, shrinking to zero for the oldest investors.

Business Owners Are Quite Different

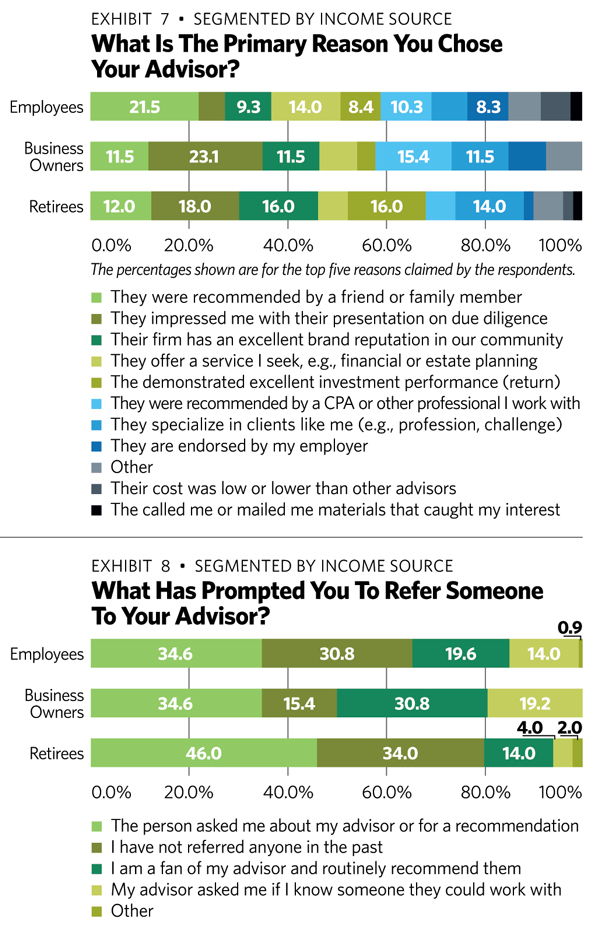

Some of the most significant differences in investor behavior appear when we segment consumers by source of income. As shown in Exhibit 7, business owners and retirees approach the process of selecting an advisor much differently than consumers who earn their income through an employer.

While 21.5% of consumers who are employed chose their advisor primarily based on the recommendation of a friend or family member, business owners and retirees placed the most trust in their own eyes and ears: 23.1% of business owners and 18.0% of retirees cited the impression the advisor made during the initial meeting as the decisive factor in their selection process. Far fewer reported being influenced by friends or family (11.5% of business owners and 12.0% of retirees).

Business owners are more likely than employees and retirees to follow the lead of their CPA and other professional advisors when it comes to settling on an advisor, with 15.4% reporting this as a primary factor. Retirees, on the other hand, are more sensitive to the investment performance of the advisor, with 16.0% of retirees reporting this as a primary factor compared to 8.4% of employees and only 3.8% of business owners.

Looking at the influence the firm’s brand has on consumers selecting an advisor, we see that retirees are most attuned to the firm’s reputation in the community, with 16.0% reporting this as a primary factor. In comparison, 11.5% of business owners and 9.3% of employees cited brand reputation as the decisive factor.

Moving on to referrals, as illustrated in Exhibit 8, business owners are the most likely to recommend their advisors, with only 15.4% reporting that they have never made a referral compared to 30.8% of employees and 34.0% of retirees. Business owners may also very well be the most enthusiastic promoters of their advisors. Among entrepreneurs, 30.8% say they are raving fans and regularly refer people they know to their advisor. In comparison, raving fans make up 19.6% of employees and 14.0% of retirees. Business owners are also most likely to positively react to a request for a referral from their advisor, with 19.2% having made a referral that way compared to 14.0% of employees and only 4.0% of retirees.

Conclusion

Financial advice and its cousins—financial planning, investment advice and wealth management—are relatively new services. Consumers are still gathering information on the value provided by these services and how best to evaluate potential service providers. As this survey conducted by The Ensemble Practice LLC among consumers with income over $100,000 shows, there are many characteristics of the exact situation of the consumer that advisors should understand and incorporate in their strategies.