As originally published by Financial Advisor magazine.

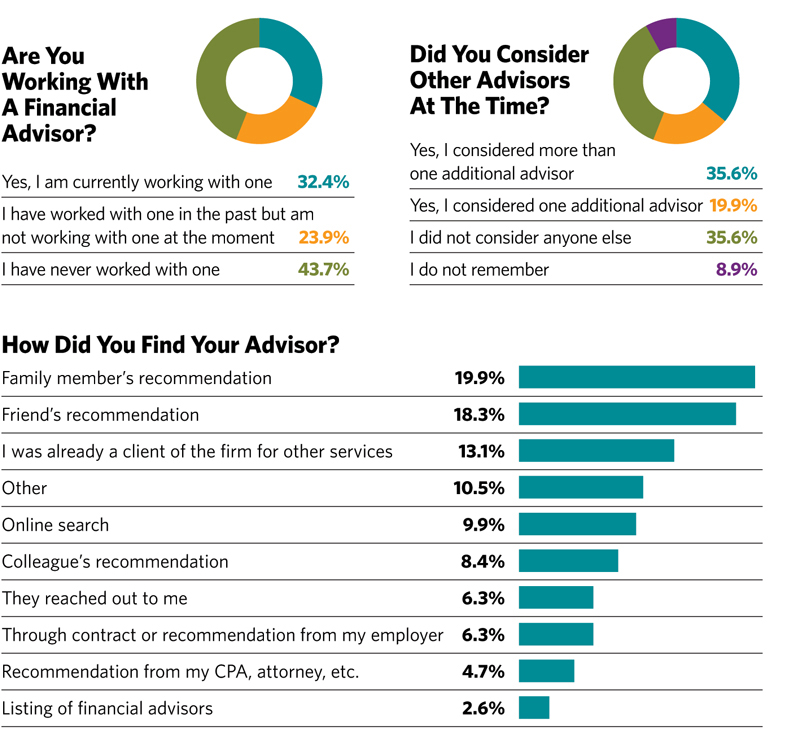

For every client your advisory firm has, there’s at least one more you could have in the future, someone you wouldn’t even have to compete for. The Ensemble Practice found in a recent survey that only 32.4% of high-income consumers have advisory relationships. And though most people haven’t ever worked with an advisor, the industry has already managed to disappoint close to a quarter (23.9%) of its potential clients—those who’ve had an advisor, left and never come back.

When seeking out new professionals, clients trust their friends and family the most, but they also notice brands and assign a lot of importance to the reputation of a firm. The way consumers approach their search varies by gender, by wealth and by source of wealth, but it’s universal that consumers begin their search by asking someone they are close to: “Do you know a good advisor?”

To reach those ready to receive advice, firms must both invest in their existing client relationships and seek the endorsement of present-day clients—but also reinforce their brands through marketing efforts.

Who Has An Advisor?

In July 2021, we surveyed 500 consumers with a personal income of $100,000 or more (most had a net worth between $500,000 and $5 million), targeting them regardless of whether they used advisors.

We found that financial advice is only reaching a third of its potential clients. Only 32.4% of the respondents currently worked with a financial advisor, while 43.7% never had. Interestingly, nearly a quarter of those surveyed had worked with advisors in some capacity but chose to leave the relationships.

These results suggest that advisors will see a lot of opportunity in the future, but only if they can help those people who have never experienced advice come to understand their services and learn how to select the best provider. There are far more people who’ve never benefited from financial advisors or seen their value than there are who have. If firms could only identify the “triggers” that cause people to seek advice—and then persuade those people to trust a firm’s financial wisdom—there’s an enormous potential for growth. But that’s a formidable challenge, and we have already made some mistakes.

The opportunity is present in every wealth segment. Even among those investors with more than $5 million in net worth, 18.4% have not formed an advisory relationship; 26.4% of those with between $1 million and $5 million have also never had one. Nor have the 41.6% of consumers with between $500,000 and $1 million.

Sadly, we have already disappointed many people. It’s going to be hard to persuade that quarter of the respondents who have already left their advisors to come back. And the population of those “disappointed” people who left an advisor can be found throughout the wealth spectrum: 25.7% of consumers with between $1 million and $5 million have left a relationship, while 24.2% of those in the half million to $1 million bracket have.

Still, wealthier consumers are most likely to work with an advisor. So are business owners and retirees. Age is also a determining factor, if only through its correlation to wealth. Young and wealthy individuals are just as likely to hire an advisor as those who are middle-aged and wealthy.

How Do They Choose?

There are three steps that people take in choosing an advisor:

Exploration: When they have the interest in advice (but not yet the intention to act), people begin collecting information. During this stage, they ask around and compile a list of firms to check out. They also do some basic research on how to choose an advisor, what questions to ask and what to expect. Many consumers may not get past this stage and fail to act on that initial interest.

Whether your firm appears on somebody’s exploration list depends on its reputation and people’s awareness of your brand.

Examination: During this stage, people have compiled the list of names and begin to connect with potential advisors, performing due diligence. They will contact firms to talk and exchange information. They’re also likely to conduct their own research by reading through an advisor’s website and social media and by seeking references. A firm’s ability to respond to inquiries in a timely and compelling manner, as well as the results of the individual’s behind-the-scenes research, determine whether an advisor gets examined at this point. An advisor’s success in this stage is a function of their sales process and skill.

Determination: In the last stage, the consumer chooses the firm they like best and engages in some level of contracting, setting expectations and negotiating price and other parameters of the engagement. An advisor’s success in the determination stage is a function of their responsiveness and negotiation skills.

These three stages are not always distinct. Consumers may perform them simultaneously and not in a very systematic manner. In fact, when they select an advisor, in 35.6% of cases they look at only one.

The Exploration Stage

When looking for an advisor to trust, people mostly seek out the recommendations of people they know. When asked how they first heard about their advisor, 38.2% of consumers said the names came from friends (18.3%) and family (19.9%). Another 13.1% of the clients said they were engaging the firm for some other service and then added financial advice later. Some 9.9% got the names from online searches and 10.5% said it was some other resource. Notably, CPAs and attorneys did not play a significant role as referral sources in the survey, perhaps because many already offer advice as part of their distribution strategy.

These results indicate that advisors who want to be considered in the exploration stage most of all have to impress their existing clients. While advisors should not perhaps be explicitly asking for referrals (only 12.0% of referrals originate this way), they should be asking questions such as: “Who are your closest friends?”

The decision to seek an advisor in the first place is not driven by a single event. Of the consumers surveyed, 17.8% cannot identify any specific occurrence or challenge that sparked their search. The most discernible reason, named by 15.7% of them, was that they felt some general anxiety over their ability to meet their goals. And it’s also significant that 11.5% said they were urged by others to seek out help.

Only 11.5% of new advisor searches were prompted by consumers leaving one advisor and seeking another. In fact, it is entirely possible that once clients leave their advisor they leave the world of advice altogether rather than seeking a replacement. The same phenomenon holds true for exercise gyms. When clients leave their gym, they very often do not sign up for membership at another one, instead choosing to work out on their own or just focusing on watching Bachelor in Paradise on TV (Tuesdays now).

The Examination Stage

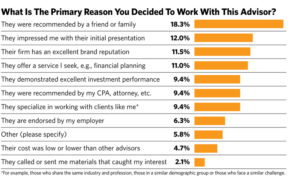

When it comes down to choosing an advisor to work with, consumers once again trust the recommendations of the people close to them (something cited by 18.3% of those in the Ensemble Practice survey). Presentation skills also matter a lot here, with 12.0% of consumers selecting their advisor after seeing an impressive presentation. The strength of the brand is important, too, with 11.5% of consumers citing it as the primary factor driving their choice. (Notably, 49.2% of advisory clients surveyed work with a national brand firm.) Investment performance is also quite important, with 9.4% of consumers selecting their advisor primarily based on that factor.

Cost plays only a very small role as a factor in the examination process, with only 4.7% of consumers choosing their advisor primarily for that reason. Just as no one wants to go to the cheapest heart surgeon, very few consumers are looking to entrust their financial futures to the lowest bidder.

When advisors first meet with a client, that client is usually theirs to lose. Indeed, 35.6% of consumers interview only one. Another 19.9% interview two. Just over a third (35.6%) evaluate more than that during the examination stage.

When advisors realize that their competition is relatively scarce, they should change the dialogue. Rather than seeking to match terms, price and service offerings with other firms, they should above all focus on the needs of the client in front of them. Can they provide answers to the questions that keep this client awake at night? Can they connect with the client’s interests and values?

The importance to a consumer of the advisory firm’s reputation is equal to the importance they place on the advisor’s personal skills and reputation. When asked to weigh the importance of an advisor’s reputation against the reputation of the firm as a whole in the selection process, 39.8% of consumers favored the firm to some degree and 37.7% favored the advisor. Nearly a quarter of consumers (22.5%) valued them equally.

Only 13.3% of the respondents considered the brand of the firm “not important” when choosing an advisor, while 22.5% said it was “extremely important” and 26.2% said “very.” This result will suggest that the old-fashioned personal networking will be much more effective if it is complemented with impactful marketing.

The Determination Stage

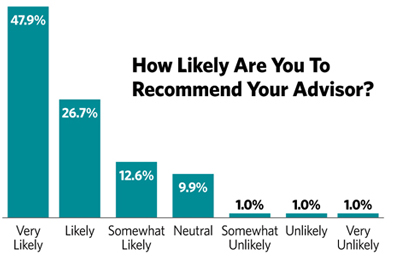

Advisory firms should look at this data with optimism and a sense of opportunity. The survey data offers clarity about concepts we have intuitively known and seen in other research.

To be considered and ultimately selected by prospective consumers, advisors must begin with their existing clients—people who will be the primary source of information for others seeking out their first advisor. That said, advisors cannot and should not neglect their marketing plan. Their brand matters a lot. While it can work to do individual marketing and to cultivate the influence of friends and family, the power of a firm’s brand is undeniable, and it should be expanded and leveraged. Advisors who create a brand that resonates will improve their chances of getting through the exploration stage and being selected when the prospect is making a determination.

The Disappointed

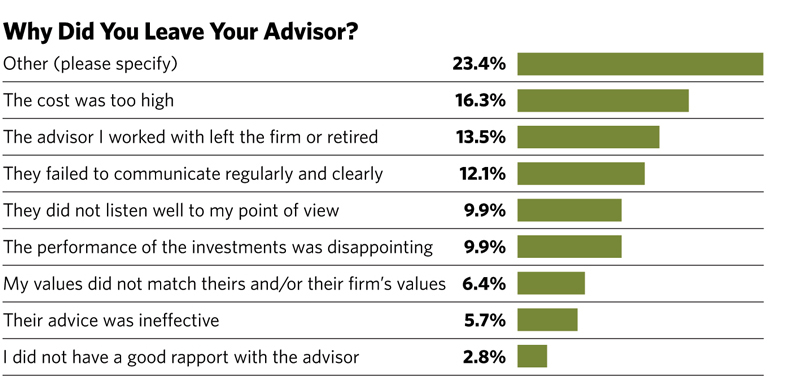

As much as the survey results reveal a lot of opportunity for advisors in the future, the data also shows that we have already disappointed many potential clients. Again, nearly a quarter of consumers (23.9%, to be exact) have left an advisor and have no immediate plans of coming back.

These disappointed consumers left for a variety of reasons, from their advisor’s failure to communicate (12.1%) to poor performance (9.9%) or a mismatch of values (6.4%) to the perception of high costs (16.3%). Most commonly, there was just a general sense of dissatisfaction with the relationship (this is how we interpret the “other” response selected by the 23.4% of those surveyed).

Notably, 13.5% of the respondents left when their advisor retired or changed firms. As we already know, clients value both their advisor and the firm’s brand. When advisors leave and consumers are asked to choose between them and the firm, many elect to leave the relationship entirely.

Still, many consumers who have left may be willing to find someone else. Only 12.1% of the “disappointed” say there is no event or circumstance under which they would seek the help of a financial advisor again.

The Available

While “the available” group of consumers, those currently without an advisor, are not as rich, they do have wealth—11.2% hold investable assets worth more than $1 million. This group is a bit younger and more likely to be female. Women represent 52.3% of respondents without an advisor, while they make up 45.5% of respondents who do have one. The group of available consumers can also be high earners: 18.6% have household income of more than $200,000.

When asked why they don’t have an advisor, 21.7% of those in this group say that most of all they lack the time and knowledge required to select one. That represents a great opportunity for the industry. Some of the customers in the “available” category are also worried about the cost of engaging an advisor (a problem named by 16.7% of them), while others worry about fraud and the risk of bad advice (cited by 14.7% of this group). Again, these problems present great opportunities for outreach.

As many as 15.1% of available consumers have some interest in seeking an advisor in the next 12 months. That said, these consumers are not exactly low-hanging fruit. Only 5.0% believe they are “very likely” or “most likely” to seek advice.

No Pied Piper

Though most people don’t have advisors, there is no Pied Piper strategy for leading them into a professional advisory engagement. People have diverse needs, and many things drive their behavior. Still, the opportunity for advisors to double in size is there to be had, and the fundamental principles of success hold true: invest in your existing client relationships and your brand, and broaden your reach to capture consumers who are female, younger and perhaps not quite wealthy yet.