As originally published for Financial Advisor magazine.

Success can be a self-fulfilling prophecy. Achieving it gives a firm confidence to continue

investing in growth. The momentum of recognition attracts talented people who in term create

more opportunity through their talent and ambition. The prominence in the marketplace

attracts more clients. The increase in revenue brings more profits and the profits bring even

more resources to grow.

Success, of course, has many more dimensions than just size. An advisory firm being one of the

largest in terms of assets under management may not always have the most revenues, be the

most profitable, deliver the best quality of client services or create the best culture and

opportunities for its employees. Nonetheless, the heavyweight division has always been the

glamor division of boxing and the largest RIAs in the country are certainly heavyweight – they

have the “punching power” and they command the attention of the industry.

What it Takes to Be Top 100

To be included in the top 100 RIA list (“Heavyweights”) a firm had to have more than $5.4

billion in assets under management (AUM) at the end of 2021. To be ranked in the top 10

required well over $47 billion in AUM. These numbers clearly show that RIAs are no longer

small organizations operated by a few partners. In fact, the average heavyweight firm had a

team of 180 employees servicing a median of 1,551 clients.

The bar to be a heavyweight (Top 100) keeps growing dramatically as well. Five years ago, in

the 2017 edition of this list the cut-off to be included was $2.3 billion in AUM – half the size

needed today. In 2012 that number was $1.1. billion in AUM.

Much of that tremendous growth was created by the financial markets – the S&P 500 has more

than tripled between the end of 2012 and the end of 2021. Much of the growth also came from

consolidation – a powerful current that continues to reshape the RIA ecosystem. Still, the top

firms also have achieved tremendous organic growth and the corresponding organizational

development.

Heavyweights Are Consolidators

The industry is consolidating rapidly and increasingly the top firms in the industry are those that

are actively on the path to merge and acquire. At least four of the top 10 are very active in the

M&A market – CAPTRUST, HighTower, Mariner and Wealth Advisor Group have all completed multiple transactions in the last two years. Others on the top 10 list are no strangers to acquisitions either. In fact, M&A may be the most common path to the top 10 and most heavyweights participate in that activity.

A good measure of the impact of consolidation in the industry is the participation of

institutional capital in the industry. Forty-one percent of the Top 100 firms on the list report

having institutional investors. This number may very well be underestimating the impact of

institutional capital in the industry as more than a handful of firms are stating that they do not

have outside investors despite well-publicized infusions of private equity capital or ownership

by financial institutions.

In contrast, 20% of the “Cruiserweights” (size rank from 100 to 200) have institutional investors

and only 7% of firms between rank 200 and 500 report outside ownership.

Moving Up and Moving Down

Canadians say that you don’t have to be faster than the bear, just faster than the other guy

running from the bear. Except for … the other guys are really fast. The heavyweight list is very

dynamic and changes a lot.

To track the fortunes of the firms who were on the list 10 years ago in 2012 we examined what

happened to 10 randomly selected firms from the old list. Of the ten firms we tracked, two

continued to grow and dramatically improved their position on the list. One of the participating

firms was acquired by an even larger firm and is now still on the list but now as part of the

larger organization. Two firms dropped off the top 100 list – they continued to grow but simply

not enough to stay in the Top 100. One firm broke up into two firms who are not on the

heavyweight list while remaining in the top 500. Two firms appear to have opted out of

participation despite being likely to make the Top 100.

Clearly, standing still is not an option if a firm desires to remain on of the top in the industry.

Size is an advantage but it is an advantage that requires expensive maintenance.

Heavyweights Are Surprisingly Faster

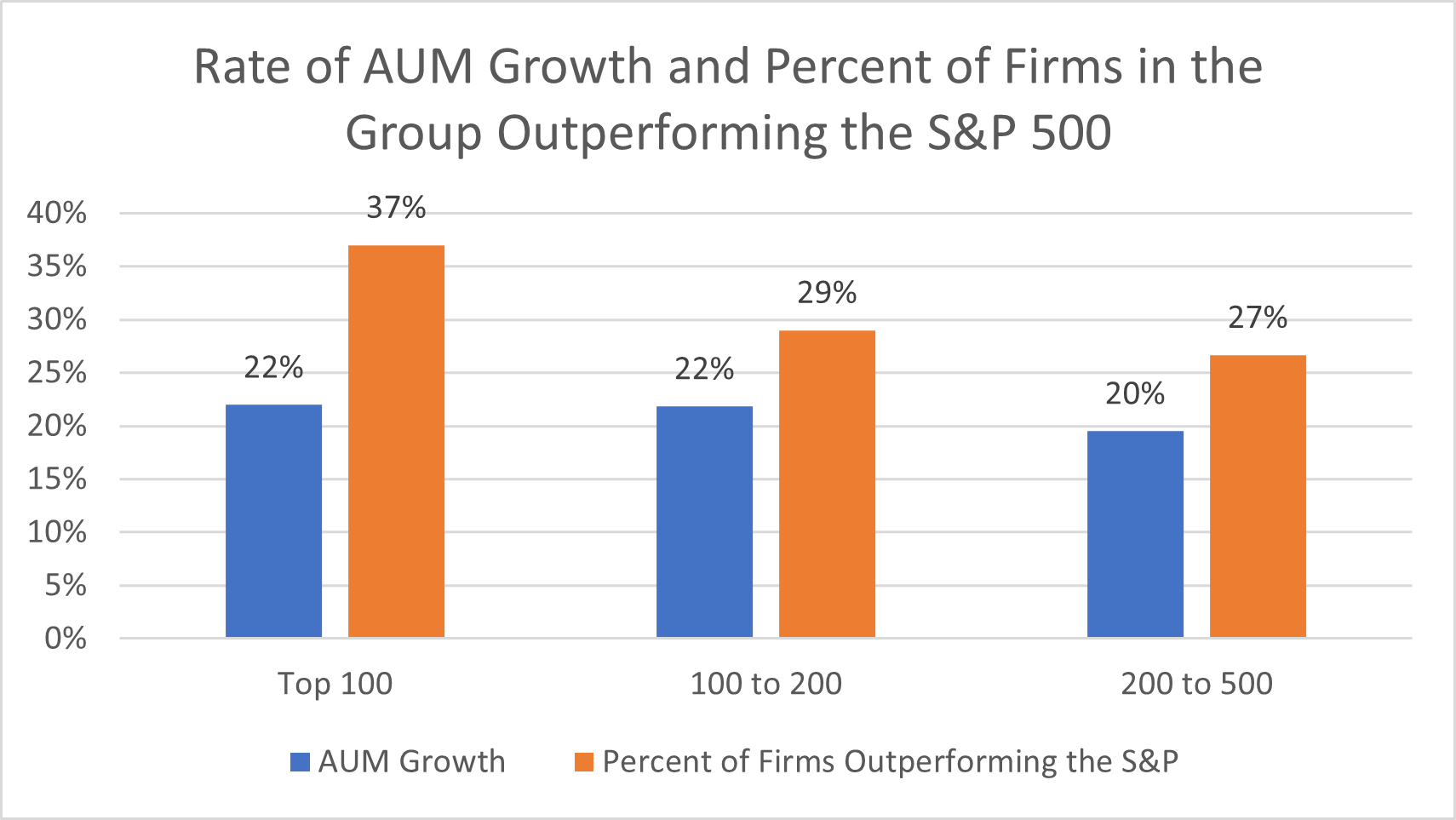

The advantage of size is remarkably visible in the rate of growth of the largest firms. The firms in the top 100 list grew at a median rate of 22%, the same rate as their smaller counterparts in the Cruiserweight Division and faster than those between 200 and 500 (“middleweights”) who grew at 20%. Mathematically we should be seeing the opposite – the smaller denominator should make it easier for smaller firms to grow at a faster rate.

The advantage of size is remarkably visible in the rate of growth of the largest firms. The firms in the top 100 list grew at a median rate of 22%, the same rate as their smaller counterparts in the Cruiserweight Division and faster than those between 200 and 500 (“middleweights”) who grew at 20%. Mathematically we should be seeing the opposite – the smaller denominator should make it easier for smaller firms to grow at a faster rate.

This is even more apparent if we measure the growth in AUM relative to the market

performance. If we set the bar at 26.6% - the return of the S&P 500 in 2021 we find that 37% of

the top 100 grew faster than that rate, compared to 29% of the Next 100 and 27% for the 200

to 500 Group.

Clearly acquisitions, combined with bigger marketing budgets, larger reputation and more

business developers create an advantage for the largest firms.

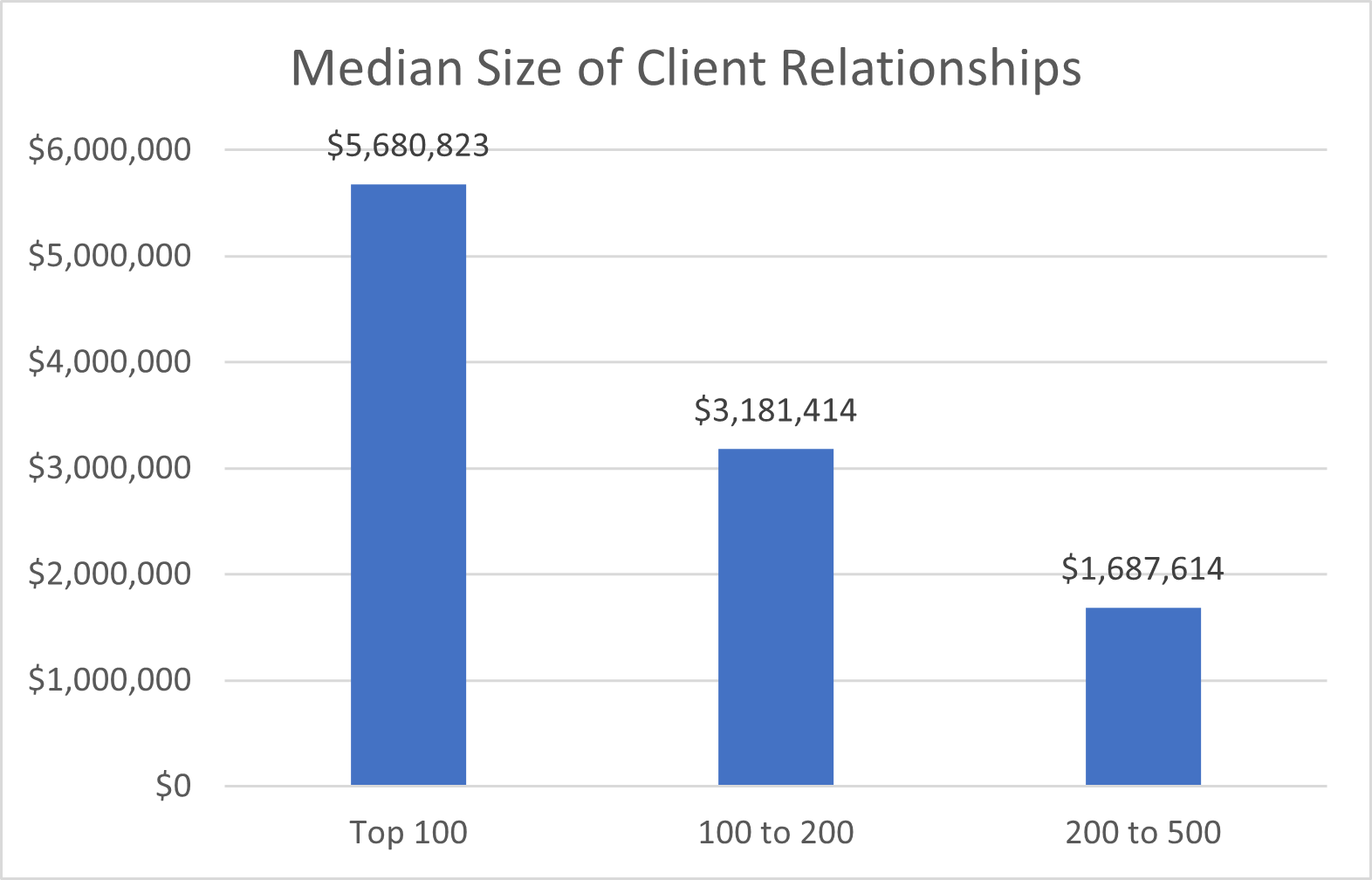

If You Want Larger Clients – Be A Larger Firm

Most advisory firms constantly look to work with larger and larger client relationships. Larger

client relationships promise to create more profitability and a reputation of sophistication of

services. It seems from our data that if you want to work with larger clients, you should strive to

be a larger firms. The Top 100 firms clearly demonstrate that through the outstanding size of

their client relationships.

The heavyweights have an average assets under management (AUM) per client of $5,608,823 compared to $3,181,414 for the cruiserweights and $1,687,614 for the middleweights.

The heavyweights have an average assets under management (AUM) per client of $5,608,823 compared to $3,181,414 for the cruiserweights and $1,687,614 for the middleweights.

The outstanding size of client relationships can be traced directly to the effect of size. The largest clients frequently prefer the richer resources of bigger firms. They may often also be lured by the premier reputation of the firm. Many of the firms on the list are not only one of the largest in the country but notably the overwhelmingly largest firm in their local market.

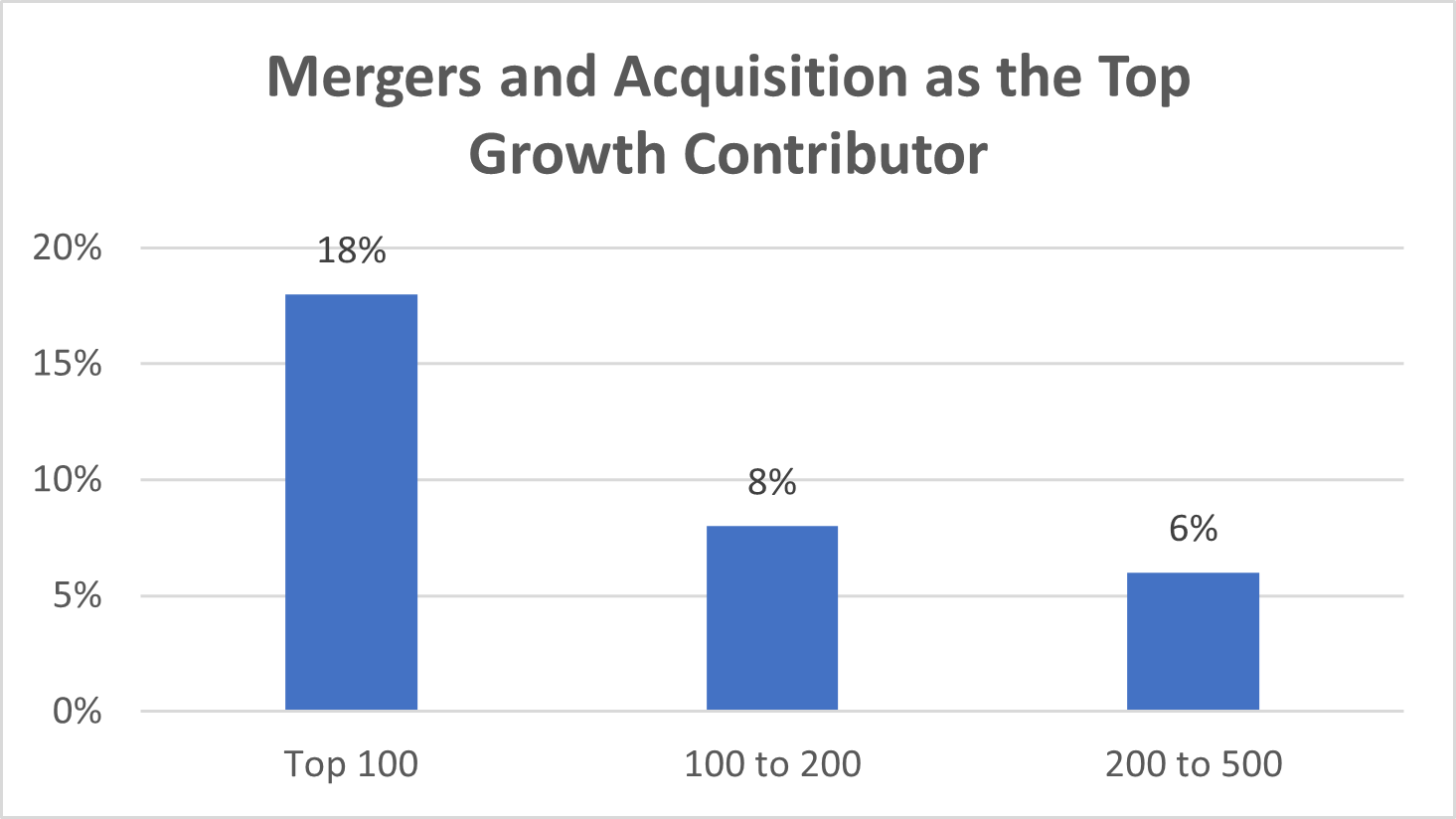

If You Want to Be A Large Firm – You Might Have to Merge and Acquire

Mergers and acquisitions are clearly the way to the top. Not only are nearly half (more than half if they answered the question accurately) of the top firms at least partially owned by institutional investors but they are also aggressively seeking to merge and acquire.

Mergers and acquisitions are clearly the way to the top. Not only are nearly half (more than half if they answered the question accurately) of the top firms at least partially owned by institutional investors but they are also aggressively seeking to merge and acquire.

Of the top 100 firms, 18% say that their number one growth driver is mergers and acquisitions.

For comparison that is a relatively more rare strategy for the next 100 firms (ranking from 100

to 200) and the firms ranked from 200 to 500.

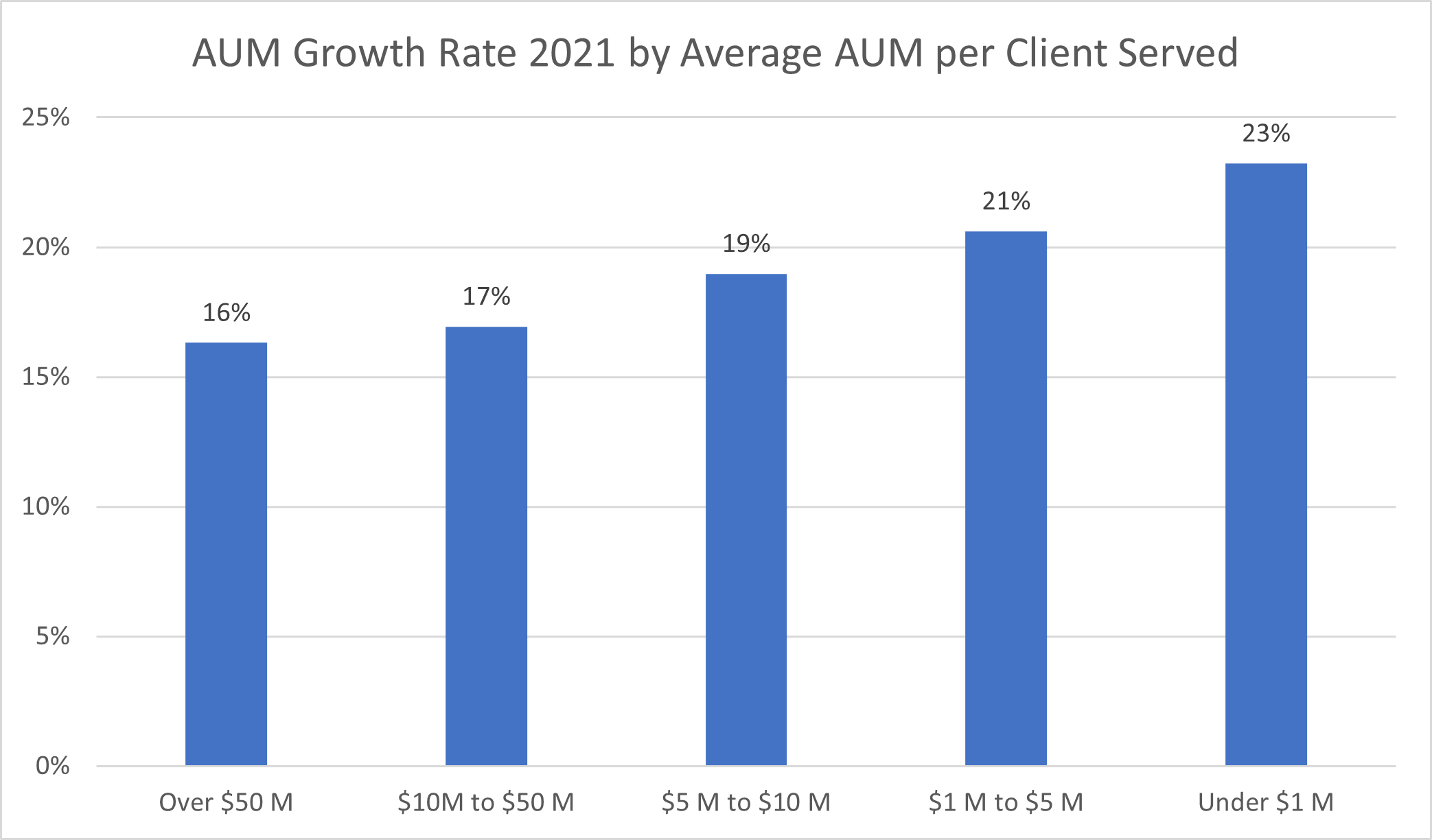

If You Want to Grow Faster – Consider Smaller Clients

While larger clients are usually highly desired firms may want to consider smaller relationships

as means of accelerating their growth. If we categorize firms based on their average client size,

we will see that the smaller the target client size, the faster actually the growth.

Firms that work with clients who have more than $50 million in AUM had the slowest growth in

2021 – 16%. Those that work with the smallest clients – those under $1 million had in contrast

the fastest growth. The relationship holds true as we progress from the $50 million clients to

those with $10 million to $50 million (17%) and from $5 million to $10 million (19%) and finally

$1 million to $5 million (21%). Essentially as you move from the mass market to through the

affluent, high-net-worth and finally ultra-high-net-worth markets the growth slows down.

Some of this effect may be due to investment philosophy of the firms and the implementation

of client portfolios. It is not unlikely that the ultra-high-net-worth clients were much more

diversified beyond the S&P 500 while the smaller clients may have been more invested in the

blue-chip index. Since the S&P did much better than say emerging markets or most

international markets, we may be seeing some faster growth of the assets in smaller portfolios.

Still, our experience tells us that the high-net-worth markets are getting more and more

competitive and the fierce competition is reducing the number of opportunities available.

According to an Ensemble Practice survey of consumers, 66% of those with over $5 million in

AUM already have an advisor while 52% of those with AUM between $1 million and $5 million

have such a relationship and only 35% of the smallest clients work with an advisor.

If You Want to Grow – You Have to do Business Development

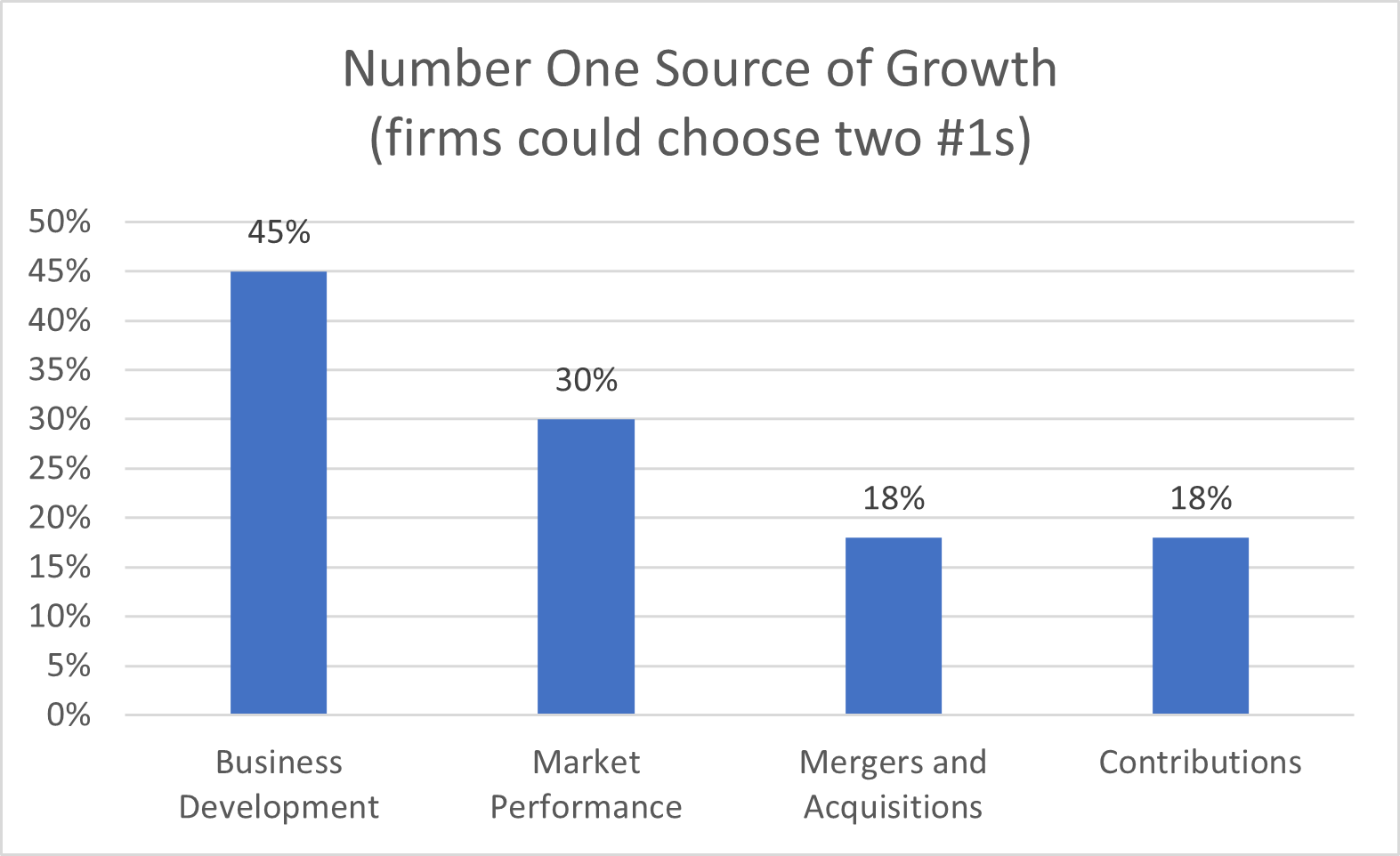

When asked about their primary source of growth in AUM for 2021, the top 100 firms point

most of all at organic growth.

Forty-five percent of firms consider business development their number one source of growth. Thirty percent of firms consider the market their primary source of growth and an equal 18% of firms relied on M&A or contributions. Firms were allowed to use multiple sources of growth as their top choice.

Forty-five percent of firms consider business development their number one source of growth. Thirty percent of firms consider the market their primary source of growth and an equal 18% of firms relied on M&A or contributions. Firms were allowed to use multiple sources of growth as their top choice.

There is no doubt that the long-term most sustainable source of growth is business

development but something is not quite right with the data. While the S&P 500 grew by more

than 26% and the Dow was over 18% only 57% of the top 100 firms had AUM growth over 20%.

Only 22% of firms grew faster than 30%.

To me this suggests that if we were to realistically look at the AUM growth in 2021, the number

one contributor for most firms was the market. Nothing wrong with the market but we just

have to be realistic about how much of the industry success has come from it.

If You Want a Faster Career – Consider Joining a Smaller Firm

Success benefits a lot the team of an advisory firm as well. Successful firms grow faster creating

more opportunities. They pay more both in terms of bonuses and base compensation. They

create more career opportunities. Still… there small firms offer perhaps a faster way to the top.

One measure of the organizational structure of advisory firms is the percentage of team-

members who are considered partners or “top executives.”

In the top 100 advisory firms, 16% (one out of six) of the team members are either partners or

executives. This number grows to 18% in the Next 100 and is 24% for the smaller firms with

ranking from 200 to 500.

In essence, in smaller firms, more team members are partners and perhaps there are many

opportunities to grow your career to that level. As firms grow larger, they create more positions

and more diverse paths to advancement but perhaps the journey is slower and a smaller

percentage of the team is able to travel it.

Conclusion

They say that “success has many parents and failure is an orphan…” There are many people

who deserve credit for the success of the top firms. Their advisors for the amazing work they do

with clients which continues to create wonderful relationships and contributions. The

marketing teams that deliver organic growth. The executives who execute complex

negotiations to grow through mergers and acquisitions. The staff whose work delivers

retention. The markets who gave us an amazing boost in 2021!

The growth of the community of independent-minded firms is mesmerizing in its speed and

scope. It has created a prosperous and evolving eco-system of enterprises that continue to set

records for size but even more importantly continue to create opportunities for their teams,

care for their clients and return to their investors. Congratulations to the top 100!